The issue of Equity and preference share capital for cash only.Cash proceeds from the issue of debentures, loans, notes, bonds, and other short-term borrowingsĮxamples of cash inflow from financing activities are:.Cash proceeds from the issue of shares or other similar instruments.goodwill, trademark etcĬash flows from financing activities are the cash paid and received from activities with non-current or long-term liabilities and shareholder’s capital.Ĭash flow arising from Financing activities typically are: Cash sale of investments made in the shares and debentures of other companiesĬash receipts from collecting the Principal amount of loans made to third partiesĮxamples of Cash outflow from investing activities are:.Cash sale of plant and machinery, land and Building, furniture, goodwill etc.Cash receipts from the repayment of advances and loans made to third partiesįurthermore, Examples of Cash inflow from investing activities are:.

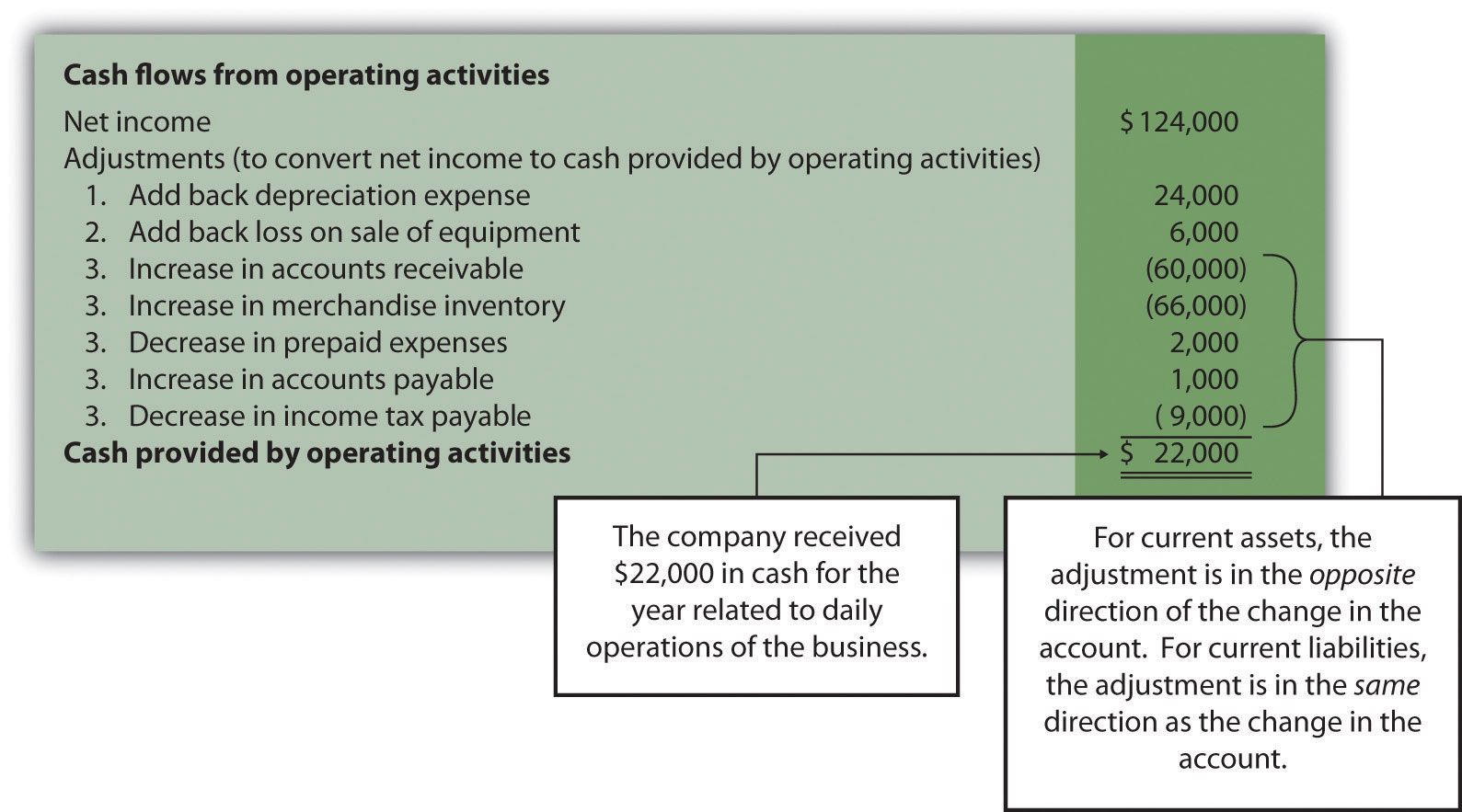

Cash payments to acquire shares or debenture investment.Cash receipts from disposal of fixed asset.The cash flow from investing activities is derived by adding all the cash inflows from the sale or maturity of assets and subtracting all the cash outflows from the purchase or payment for new fixed assets or investments.Ĭash flow arising from Investing activities typically are: A decrease in an item of current liability causes an increase in cash outflow because of payment of the liabilityĬash from operating activities = Operating profit before working capital changes + Net decrease in current assets + Net Increase in current liabilities – Net increase in current assets – Net decrease in current liabilities Investing Activities.An increase in an item of current liability causes a decrease in cash outflow because cash is saved.A decrease in an item of current assets causes an increase in cash inflow because cash is released from the sale of current assets.An increase in an item of current assets causes a decrease in cash inflow because cash is blocked in current assets.Stage 2: Effect of changes in Working Capital is to be taken into as follows: Operating profit before working Capital changes Less: Non-cash and Non-operating Items which have already been credited to Profit and Loss Account like Loss on the sale of Long-term Investments Stage 1: Operating profit before changes in working capital can be calculated as follows: Edit Net profit before Tax and extra ordinary ItemsĪdd: Non-cash and non-operating Items which have already been debited to profit and Loss Account like The effect of changes in working capital.Calculating the operating profit before changes in working capital.The cash flow from operating activities are derived under two stages An increase in a liability or an equity account suggests a cash inflow.Preparation under Indirect method Operating Activities To calculate cash flows from financing activities, the balances for non-current liabilities, equity accounts and dividends must be examined.

Changes in non-current liabilities and equity for the period can be identified in the Non-Current Liabilities section and the Shareholders’ Equity section of the company’s comparative balance sheet, and in the financial statement notes. The reason for this is interest is an expense that is reported on the income statement, and are considered to be part of a business’s daily operations, therefore payments for interest are reported as operating instead of financing activities. It is important to note that although dividend payments to shareholders are considered as a financing activity, payments of interest to creditors are not. Debt transactions, such as issuance of debt, and the related repayment of debt, are also frequent financing events. Shareholders’ equity transactions, like issuing of shares, payment of dividends, and share buybacks are very common financing activities. Cash flows from financing activities always relate to either long-term debt (non-current liabilities) or cash inflows and outflows from/to shareholders/investors (equity) transactions and may involve increases or decreases in cash relating to these transactions.

0 kommentar(er)

0 kommentar(er)